Scalping is an approach to trading that involves taking advantage of small price movements in financial markets. The goal is to make a series of quick and frequent trades to accumulate profits. Scalpers are often in and out of the market in a matter of seconds or minutes, making it a high-intensity, high-reward strategy.

Understanding Scalping

Before we dive into the strategies and techniques, it’s crucial to have a solid understanding of what scalping entails. Scalpers target very short timeframes, seeking to profit from small price fluctuations. They often trade with large positions, making minimal profits on each trade but compensating with the sheer volume of transactions.

The Psychology of Scalping

Successful scalping isn’t just about numbers and charts; it’s also about psychology. Scalpers need to stay cool under pressure, make quick decisions, and remain disciplined. Emotions can be your worst enemy in the world of scalping, as hesitation and second-guessing can lead to losses.

The Right Instruments

Not all financial instruments are suitable for scalping. Forex pairs, stocks with high liquidity, and cryptocurrencies are often the go-to choices for scalpers. These markets offer the necessary volume and price movements that make scalping profitable.

Technical Analysis in Scalping

Scalping, as a high-frequency trading strategy, heavily relies on technical analysis to make swift and informed decisions. In the realm of scalping, understanding the intricacies of price charts, indicators, and patterns is absolutely critical. Here’s a closer look at how technical analysis plays a pivotal role in scalping:

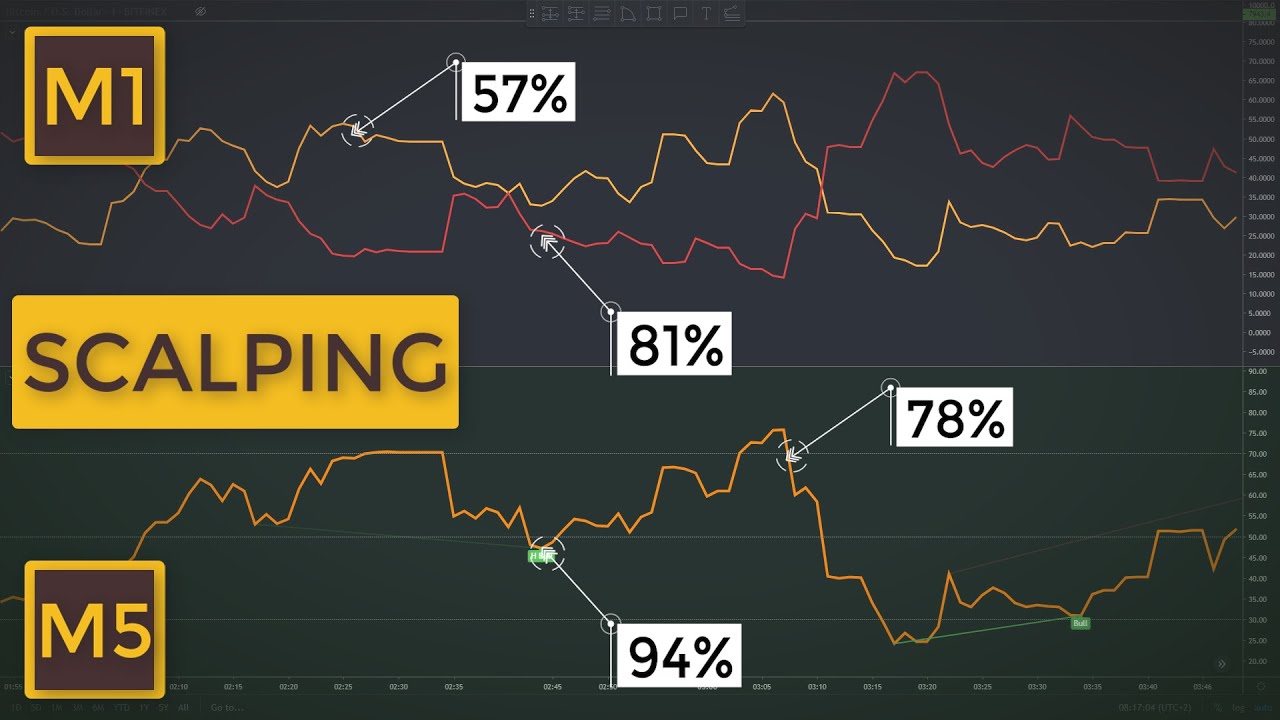

- Price Charts: Scalpers constantly monitor price charts, especially those with shorter timeframes. One-minute or five-minute candlestick charts are common choices. These charts provide a visual representation of price movements and help scalpers identify trends, reversals, and potential entry and exit points.

- Indicators: Scalpers often use a variety of technical indicators to refine their trading decisions. Common indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands. These indicators offer insights into market conditions, overbought or oversold scenarios, and potential trend reversals.

- Patterns: Recognizing chart patterns is a fundamental aspect of technical analysis in scalping. Patterns like flags, triangles, and head-and-shoulders formations can act as signals for scalpers. These patterns can indicate potential price movements, guiding scalpers on when to enter or exit a trade.

- Support and Resistance Levels: Scalpers pay close attention to support and resistance levels on price charts. Support represents the price level at which an asset tends to stop falling and may even bounce back, while resistance is the level at which it tends to stop rising. Scalpers often buy near support and sell near resistance, capitalizing on these predictable price bounces.

The Art of Timing

Timing is everything in scalping. Let’s delve into the crucial aspects of timing your trades for maximum profitability.

Market Openings and Closings

The opening and closing hours of financial markets can offer substantial price movements. For instance, currency pairs often experience volatility at the start of the trading day. Scalpers keenly watch these moments for opportunities.

Economic Events and News Releases

Economic events, such as interest rate announcements and employment reports, can send shockwaves through the markets. Scalpers need to be aware of the economic calendar and prepare for these high-impact events.

The Power of Chart Patterns

Scalpers often rely on chart patterns, such as flags, triangles, and head-and-shoulders formations. These patterns can signal potential price movements and serve as entry and exit points.

Scalping Strategies

To master the art of scalping, you need a set of well-defined strategies. Let’s explore some of the most effective ones.

One-Minute Scalping

- This strategy involves making quick trades within one-minute candlestick intervals. It’s a high-speed approach that demands precision and discipline.

Scalping with Moving Averages

- Moving averages help identify trends and potential reversal points. Scalpers use this strategy to make trades based on the moving average crossovers.

Scalping the News

- News-driven scalping involves reacting to major news releases. Traders prepare for the anticipated market impact and make swift trades in the aftermath.

Support and Resistance Scalping

- Scalpers focus on support and resistance levels, buying near support and selling near resistance. This strategy capitalizes on price bounces at these critical levels.

Scalping with Bollinger Bands

- Bollinger Bands help identify overbought and oversold conditions. Scalpers use these bands to spot potential reversal points and make quick trades.

Volume Scalping

- Volume analysis is essential for scalpers. Monitoring trading volumes can help identify strong or weak price movements, guiding trading decisions.

Risk Management

Scalping can be highly profitable, but it’s not without risks. Managing these risks is paramount to long-term success.

Setting Stop-Loss Orders

Stop-loss orders are vital in scalping. They limit potential losses and ensure you exit a trade when it’s not going your way.

Position Sizing

Position sizing is a vital element of any trading strategy, including scalping. It’s the process of determining how much capital to allocate to a particular trade, and it plays a crucial role in risk management. Effective position sizing ensures that traders can control their exposure to potential losses while still capitalizing on profitable opportunities. Here’s a closer look at position sizing and how it impacts scalping:

- Fixed Position Sizing: In fixed position sizing, traders allocate a consistent amount of capital to each trade. For example, a trader might decide to invest $100 in every scalping trade. This method simplifies decision-making and keeps the risk level constant. However, it may not be the most efficient approach as it doesn’t take into account the varying levels of confidence in different trades.

- Percent Risk Position Sizing: Scalpers often prefer percent risk position sizing. With this approach, traders determine a fixed percentage of their trading capital that they are willing to risk on each trade. For instance, a scalper might decide to risk 2% of their total capital on a single trade. This method allows for more flexibility, as it adapts to the size of each trade and the trader’s assessment of risk. It’s a prudent way to manage capital and prevent large drawdowns.

| Aspect | Fixed Position Sizing | Percent Risk Position Sizing |

| Consistency | Allocation is constant | Allocation varies with risk |

| Risk Management | Fixed risk per trade | Adaptive risk management |

| Flexibility | Limited adaptability | Adapts to trade size and risk |

| Capital Preservation | Moderate | Strong |

| Profit Potential | Limited | Potential for larger gains |

| Psychological Comfort | Simplicity | Greater peace of mind |

Avoiding Overtrading

Overtrading can lead to burnout and losses. Scalpers must set a daily limit on the number of trades to maintain discipline.

The Art of Scalping: Pros and Cons

Like any trading strategy, scalping comes with its own set of advantages and disadvantages. Let’s weigh the pros and cons.

The Pros

- Quick Profits: Scalping can yield quick and frequent profits.

- Reduced Exposure: Scalpers are in the market for a short time, minimizing the risk of overnight events.

- Emotional Control: Scalpers need to develop strong emotional discipline.

The Cons

- High Stress: Scalping is intense and can be emotionally draining.

- Transaction Costs: Frequent trading can lead to higher transaction costs.

- Information Overload: Scalpers need to process a lot of information quickly.

FAQs

What is the minimum capital required for scalping?

The capital required for scalping can vary, but it’s recommended to have at least $25,000 to meet the pattern day trader rule in the United States. However, some brokers offer accounts with lower minimums.

Is scalping suitable for beginners?

Scalping is a high-risk, high-reward strategy and is not typically recommended for beginners. It requires experience and a deep understanding of market dynamics.

How many trades do scalpers make in a day?

Scalpers can make anywhere from a few to dozens of trades in a day, depending on their strategy and market conditions.

What is the ideal time of day for scalping?

The ideal time for scalping often coincides with market openings and major economic events, but it can vary depending on the financial instruments you’re trading.

Do scalpers hold positions overnight?

No, scalpers typically exit their positions within the same trading day. They aim to avoid overnight risks.

Can scalping be automated with trading bots?

Yes, some traders use automated trading bots for scalping, but it requires a well-defined strategy and careful monitoring.